tax loss harvesting rules

A capital loss is when you have lost value in your assets or the value of your. Mary can use the 7000 capital loss to offset any capital gains she realized this year.

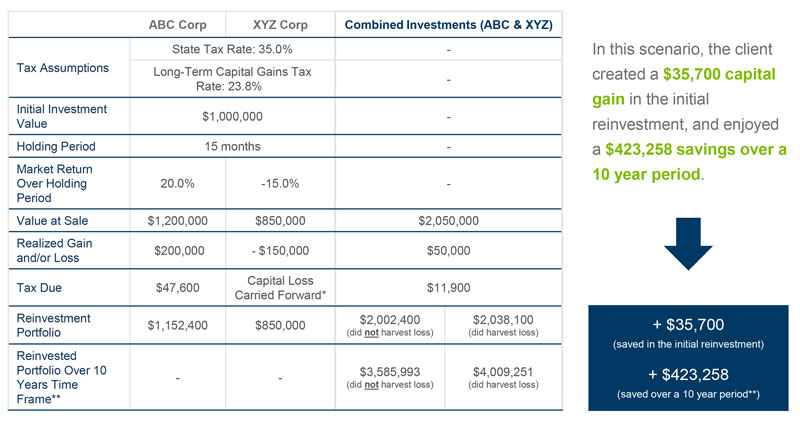

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax-loss harvesting works by selling shares for a loss to offset gains to lower capital gains tax owed.

. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the losses generated in a tax-deferred account. Investors can offset up to 3000 per year and losses can be kept in perpetuity. Rules of Tax Loss Harvesting.

So 250000 x 20 percent long-term capital gains tax rate 40000 while 180000 x 15 percent short-term capital gains tax rate 27000. You must follow IRS rules to use this technique properly and legally. And if Marys capital losses exceed her capital.

2000 x 24 480 2000 - 1500 500 500 x 24 120. While implementing tax loss harvesting the capital loss arises on the sale of loss making security is used to set off the capital gain earned by the investor during the period. But there are two main rules that you should be aware of when it comes to tax-loss harvestingwash sales rules and cost-basis calculations.

Specifically you benefit from tax loss harvesting as long as the tax you pay on the 1000 extra capital gains 10000 - 9000 in the first example above is less than the after-tax amount that 250 grows to. 3500 sales price - 4000 cost basis -500 Loss. What are the Tax-Loss Harvesting Rules.

Victor bought 1 ETH for 4000 and 5000 DOGE for 500. This results in a total tax burden of 67000. Your investments need to be in a taxable investment account.

And then when the tax comes due you actually get a 15 reduction on that. The IRS doesnt charge capital gains tax on investments held in those accounts. Tax-loss harvesting is a tax strategy where you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere.

Of course the IRS has some restrictions in place to prevent you from gaming the rules on tax-loss harvesting. 3 months later the value of 1 ETH dropped to 3500 while 5000 DOGE rose to 1000. So if its 15000 instead of paying 15000 today in 2019 you pay 13000 in 2026.

If youd like to read the entire 76-page IRS Publication 550 on investment income it has everything youd need to knowand then some. Further this loss is also used to. By harvesting that loss she can now offset those 2000 in gains with it so her short-term capital gain is reduced to 500 on which shell now only pay 120 in taxes a reduction of 75.

Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. Here are three things youll want to watch out for as you use this tax break. You defer that 15000 tax payment for seven years.

Then you would pay 300 on the 1000 extra capital gains. Tax-loss harvesting rules to know You wont find any specific reference to tax-loss harvesting in the 45000 words the IRS devotes to investment income and expenses in Publication 550. Victor sold 1 ETH at a loss.

Before the end of the year she notices another position with an unrealized loss of 1500. This is tax-loss harvesting. If harvesting losses becomes part of the plan however that number would be lower.

Tax-Loss Harvesting Rules 1. Suppose the long-term capital gain tax rate goes up to 30. While implementing the strategy of tax loss harvesting the following rules should be kept in mind.

Tax-loss harvesting cant be used on retirement plans such as 401 k IRAs or other accounts where taxes are deferred. Some investment accounts like your 401k 403b or IRA are tax-advantaged accounts. There are restrictions on using specific types of losses to offset certain gains.

It is typically used to limit the recognition of. Federal government allows investors to use capital losses to offset capital gains in a current tax year or carry the loss forward into future years. Tax-loss harvesting can help you lower your taxes by selling losses to cover gains.

A long-term loss would first be applied to. Every spring after tax time you might think about what you could have done. And Mary would use the proceeds from the sale to purchase another fund to serve as a replacement in her portfolio.

In this case lets say the investor decides to liquidate. Here is an example of crypto tax-loss harvesting. Three things to watch out for when harvesting a loss.

To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. As with any tax-related topic there are rules and limitations. Tax-loss harvesting is a strategy used to reduce your taxes.

Capital gains tax is the tax on an investments profit once it has been sold. But basically youre able to take that 100000 gain which nets you 15000 in taxes. Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability.

Learn how it works and its rules benefits limitations and more. You can use investment losses to offset capital gains taxes or up to 3000 in income each year.

What Is Tax Loss Harvesting Ticker Tape

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Upside To A Down Market Brown Advisory

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Beyond The Basics Tax Minimization Strategy

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Napkin Finance

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Definition Example How It Works

Year Round Tax Loss Harvesting Benefits Onebite

Turning Losses Into Tax Advantages